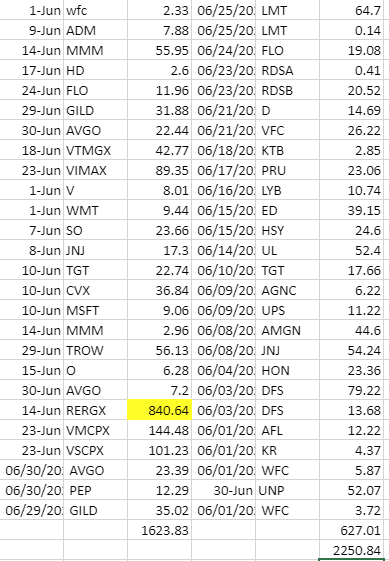

January is in books and this month i received $423 in dividends for the month .Compared to previous years some of the biggest increases were from Fundrise, ITW and DG. I was doing recurring investments in DG and ITW last year.

Compared to all my Previous January this is the second highest and compared to last year its an increase of 18%.

2022 Dividend Goal: This year my Goal is 14K in dividends ,Last year I was able to get 12.5K in Dividends ,so this year i need another 1500 in dividends to reach my goal. I am hoping to achieve this with New investments and dividend increases.

With January dividends this stands at 3% of my goal.

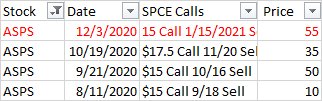

I did it using the App and it was smooth.

I did it using the App and it was smooth.